Taxes are an inseparable part of every economy, shaping how governments function and how businesses operate. Over the years, India’s tax system has undergone several reforms, but none as significant as the introduction of the Goods and Services Tax (GST). Designed to replace a complex web of indirect taxes, GST marked a turning point in India’s economic history. This blog explores the journey of GST — why it was introduced, when it came into effect, how it works, its types, tax slabs, benefits, and criticisms — giving you a complete overview of one of the biggest tax reforms in independent India.

Table of Contents

GST – AN OVERVIEW

What is GST – Goods and Services Tax, it is a single, indirect tax levied on the supply of goods and services across India. Why was GST introduced – Before GST, India had a complex tax structure:

- Different states charged their own VAT (Value Added Tax).

- The Centre charged excise duty, service tax, customs duty etc.

- Taxes were applied at every stage leading to “cascading effect of taxes” (tax on tax).

GST was introduced to: simplify taxation system and replace many indirect taxes reducing double taxation (no tax on tax), creating a unified national market, improving tax compliance with digital filing and increasing government revenue in a transparent way.

When did GST come in India – the idea of GST was first proposed by Atal Bihari Vajpayee government in 2000. Later, Constitution Amendment Bill was passed in 2016 and GST was launched on 1st July 2017 (this date is celebrated as GST Day in India every year.)

HOW DOES GST WORK? GST is applied at every stage of value addition, which is paid by the final consumer because businesses can claim input tax credit (ITC) for the tax they already paid. (this ensures that the final consumer bears the tax, not businesses at multiple stages).

Types of GST –

CGST (Central GST): Collected by the Central Government.

SGST (State GST): Collected by State Governments.

IGST (Integrated GST): Collected by Centre for inter-state transactions (between states).

UTGST (Union Territory GST): For Union Territories without legislature.

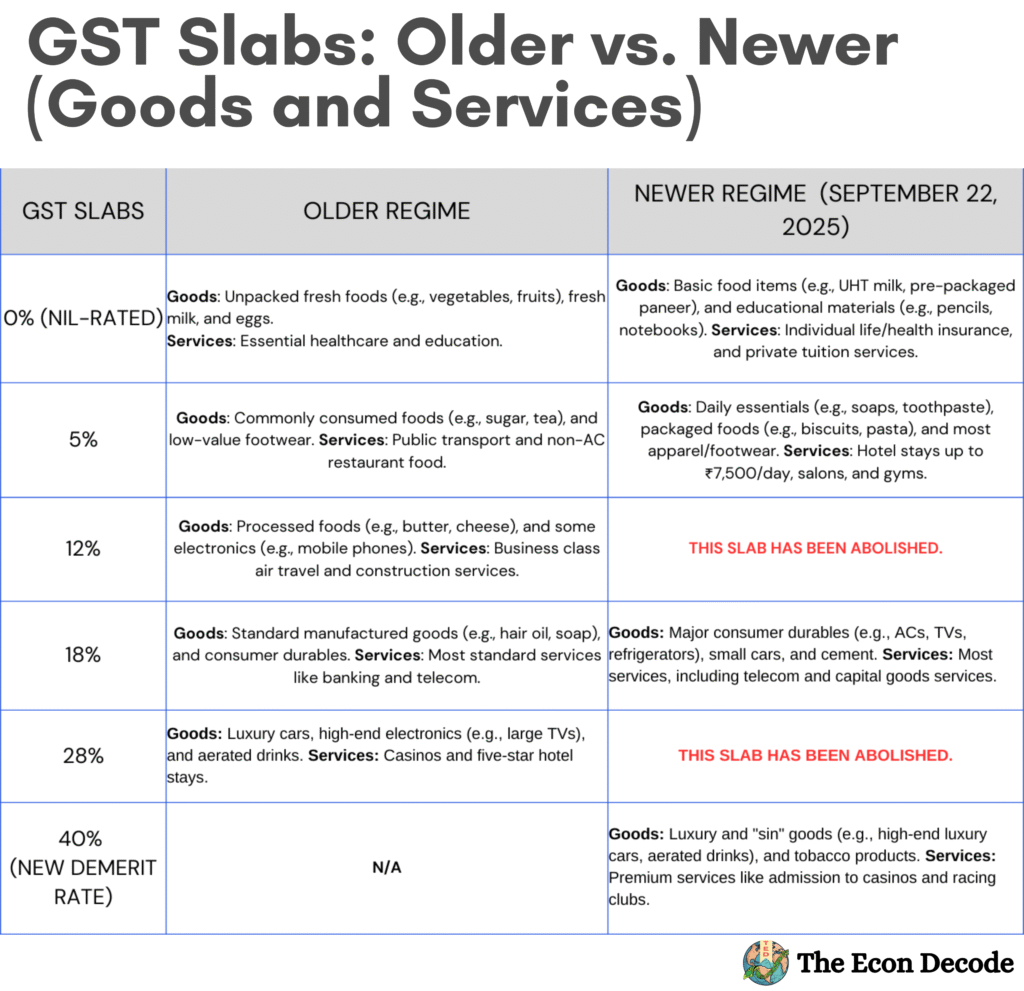

GST v/s GST 2.0

GST was first launched in 2017 and reformed in 2025 (prior to 22nd September). Following is a comparison chart of old regime v/s the new regime:

IMPACT OF GST ON INDIAN ECONOMY

Impact on Consumers

Positive:

Prices of many goods and services reduced (no more tax-on-tax).

More transparency in billing (every invoice shows GST clearly).

Uniform tax rates across states made buying cheaper in some cases.

Negative:

Some items became costlier due to higher GST slab (e.g., eating out, electronics).

Initial confusion and higher service charges in some sectors.

Impact on Producers/Businesses

Positive:

Single tax system simplified compliance (no multiple state taxes).

Input Tax Credit (ITC) reduced production cost.

Easier inter-state trade created a bigger national market.

Boost to formalization of businesses (more digital compliance).

Negative:

Compliance burden: regular online returns, strict invoice rules.

Smaller businesses (MSMEs) faced higher costs for adapting.

Frequent changes in GST rules created uncertainty.

In short, for consumers, GST made taxation clearer and sometimes cheaper but also raised costs for certain goods/services. For producers, it reduced tax complexities and costs in the long run, though small businesses initially struggled with compliance.

CHALLENGES IN IMPLEMENTING GST

Technical & Infrastructure Issues

The GST Network (GSTN) portal faced frequent crashes due to heavy traffic. Many small traders/businesses were not tech-savvy and struggled with online filing.

Compliance Burden

Businesses, especially small ones (MSMEs), had to file multiple returns every month. Maintaining digital invoices and records was difficult for traditional businesses.

Awareness & Training Gaps

Lack of proper awareness campaigns before launch created confusion. Traders, shopkeepers, and even accountants needed time to understand GST rules.

Multiple Tax Slabs

India adopted 5 tax slabs – 0%, 5%, 12%, 18%, 28% (4 now, as mentioned above (GST 2.0)), making GST more complex than expected. Classification disputes (which product goes into which slab) caused litigation and confusion.

Impact on Small Businesses

Many small traders felt increased costs due to compliance and GST registration requirements. Fear of penalties for errors in filing created stress.

Frequent Policy Changes

The GST Council kept updating rules, rates, and exemptions, which created uncertainty. Businesses found it hard to keep track of all changes.

Initial Revenue Concerns

Some states worried about loss of tax revenue, since GST replaced their VAT powers. Centre had to assure compensation for 5 years.

IMPACT ON GOVERNMENT TAX REVENUE

Short-term (2017–2019):

Revenue collection was unstable in the initial years due to technical glitches, compliance issues, and frequent rate changes.

Many small businesses under-reported sales or delayed compliance, affecting collections.

The government had to compensate states for revenue loss (as promised for 5 years).

Medium to Long-term (2019 onwards):

Tax base widened because more businesses came under the formal system (due to mandatory GST registration and digital invoicing).

Revenue improved steadily as compliance became stricter and digital tracking reduced tax evasion.

GST collections crossed ₹1.5 lakh crore per month in recent years, showing strong growth.

In short: Initially, GST caused some revenue uncertainty and dependence on state compensation, but over time it stabilized and increased government revenue by widening the tax base and improving compliance.

📌Author’s Note:

This blog is not just research — it’s a step in my journey toward working with global institutions like the IMF and World Bank.

Stay tuned and grow with me