“IN THE LONG RUN WE ARE ALL DEAD”

~JOHN MAYNARD KEYNES

Imagine a world where economic recessions spiral out of control, unemployment rises sharply, and businesses shut down. This was the reality during The Great Depression, until one man—John Maynard Keynes—challenged the status quo with his revolutionary ideas.

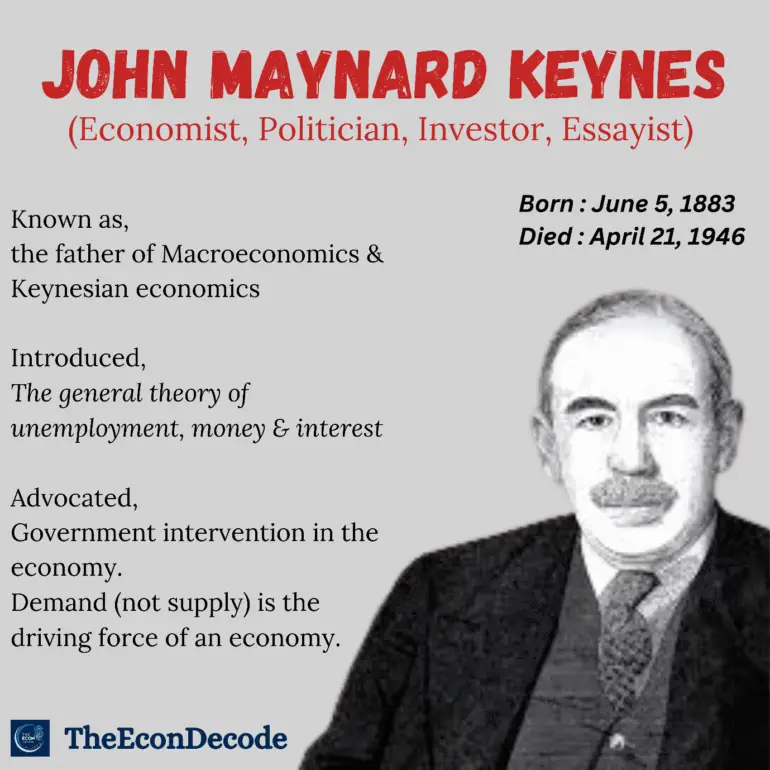

John Maynard Keynes, the father of Macroeconomics, introduced radical insights initiating socialist & planned economy against capitalist economy. He was highly criticised for promoting deficit spending by government but yet his theories play a major role in directing today’s economic policies.

Let’s explore why Keynesian economics is often used to combat recessions despite facing strong criticism.

Table of Contents

WHO WAS KEYNES?

John Maynard Keynes (1883-1946) was a highly influential economist. He studied at Cambridge University and later became a professor and fellow at King’s College. In 1915, he joined the UK Treasury and advised the government for many years.

KEYNES DEFINITION OF ECONOMICS

According to Keynes, economics is about understanding how the economy works by creating simplified models of it and applying them to the real-world problems.

BASIC PRINCIPLE OF KEYNESIAN ECONOMICS

The two basic principles of Keynesian economics says that,

- Demand (not supply) is the driving force of an economy and,

- Government should intervene the economy through spending to stimulate demand in the face of recession even if it means going into debt.

ADVOCACY OF GOVERNMENT INTERVENTION

Initially, Keynes, like his father John Neville Keynes (an economist and logician), supported the laissez-faire economy and free-market philosophy.

It was after the 1929 stock crash that triggered the great depression, Keynes came to believe that unrestricted free market capitalism was essentially flawed and needed to be reformulated.

MAJOR EVENTS THAT INFLUENCED KEYNES IDEAS

The Most famous and focused Keynesian theories on “the general idea of unemployment, interest and money” was highly influenced by The Great Depression of 1930s and his observations of The Treaty of Versailles, leading him to advocate for government intervention and fiscal policies to stabilize economies.

Other events influencing Keynes ideas were,

>THE GOLD STANDARD, Keynes criticized it as a “barbarous relic,” advocating for a managed currency.

>BRETTON WOODS CONFERENCE (1944), He played a crucial role in establishing the IMF and World Bank.

REMARKABLE FEATS

THEORY OF EMPLOYMENT

Keynes gave this theory in his famous book “The General Theory of Employment, Interest and Money (1936)”, challenging the classical economists who believed that market own can ensure full employment.

KEYNES MAIN IDEA:

1. Importance of Investment

Businesses decide how much to invest based on expected profits and interest rates. So,

Savings increases – investment falls – production falls – low employment

2. Government intervention is necessary

Keynes believed that during recessions, governments should step in to boost demand by increasing public spending and lowering taxes.

Public spending in for example infrastructure like construction of dams would require workers, reducing unemployment.

3. Employment depends on Demand

According to Keynes, total employment level in an economy is determined by aggregate demand (total expenditure by households, businesses and the government).

Low demand – less production – low employment

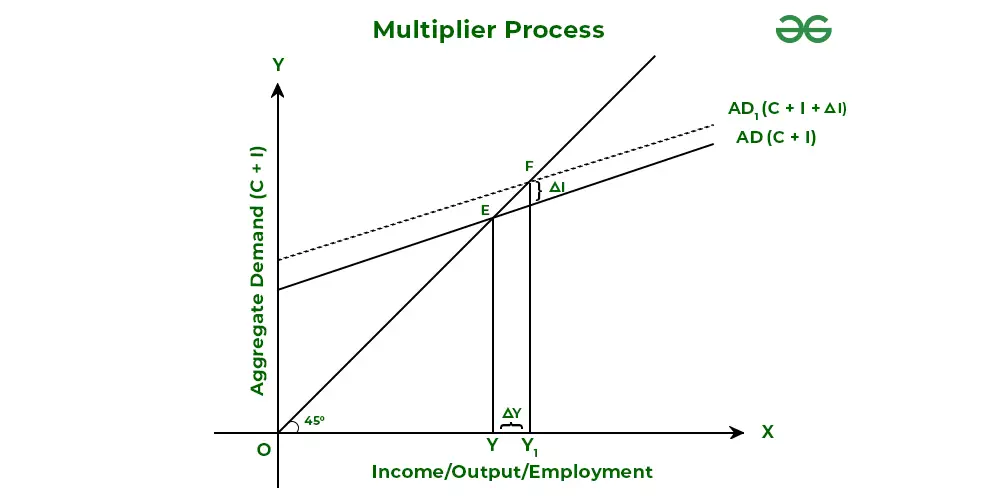

4. Multiplier effect

Keynes introduced the multiplier effect, meaning that an increase in spending (especially by government) leads to greater overall increase in income and employment.

THEORY OF INTEREST / LIQUIDITY PREFERENCE THEORY

Keynes explained the determination of interest rates in his liquidity preference theory. According to Keynes, interest is not a reward for saving (as classical economists believed) but a reward for parting with liquidity (cash).

KEY ASSUMPTIONS OF KEYNES THEORY OF INTEREST:

- People prefer liquidity

- Interest rates are determined by money supply and demand

MOTIVES FOR HOLDING MONEY

- Transaction Motive – People hold money for daily expenses and transactions. (E.g., buying food, paying bills)

- Precautionary Motive – Money is kept for unexpected expenses. (E.g., medical emergencies, job loss)

- Speculative Motive – People hold money to invest when interest rates are favourable

HOW INTEREST RATES ARE DETERMINED?

Demand for money and the supply of money together determines the ROI.

The Central Bank of a country (RBI in India) determines the money supply of the country through its monetary policies.

If

Money supply increases – ROI falls because people have more cash and if,

Money supply decreases – ROI rises because people now have less cash.

Formula Representation:

M=L(T+S)

Where:

- M = Total Money Supply

- L = Liquidity Preference (demand for money)

- T = Transaction & Precautionary demand

- S = Speculative demand

THEORY OF MONEY

John Maynard Keynes developed a comprehensive theory of money in The General Theory of Employment, Interest, and Money (1936). He rejected classical views that money is only a medium of exchange and instead argued that money plays a crucial role in influencing employment, output, and interest rates.

KEY ELEMENTS OF KEYNES THEORY OF MONEY

>Demand for Money

According to Keynes,

Total demand for money = transaction demand (daily purchases) + precautionary demand (money as safety net for unexpected expenses) + speculative demand (money for future investment opportunities)

>Money supply and Interest Rates

If money supply increases → Interest rates fall → More investment → Economic growth.

If money supply decreases → Interest rates rise → Less investment → Economic slowdown.

This idea is central to modern monetary policy, where central banks control money supply to manage inflation and growth.

>Role of money in Employment and Output

Unlike classical economists, Keynes argued that,

Money directly influences demand → Higher demand leads to higher production and employment.

Government intervention is necessary → If demand is low, the government should inject money into the economy to boost spending

Keynesian Economics in Action: How Government policies reflected keynesian economics

Today, Keynesian economics is widely preferred due to its practical approach and is actively applied during global crises by the world. Some of the events/crises are mentioned below:

THE NEW DEAL

Keynes theories were widely adopted on the onset of The Great Depression.

New Deal, a series of government programs that directly reflected the Keynesian principle that even a free enterprise capital system requires some federal oversights.

Policies such as expanding deficit spending were also adopted.

GREAT RECESSION SPENDING

In response to the Great Recession of 2007-2009, Barack Hussein Obama II, President of USA, took several steps that reflected Keynesian economic theory.

Signed the American recovery and reinvestment act, an $831- billion government stimulus package designed to save existing jobs and create new ones.

COVID-19 STIMULUS CHECKS

In the wake of covid pandemic of 2020, the US government under Donald Trump and Biden offered a variety of relief, loan forgiveness, and loan-extension programs, that reflected the principles of Keynesian economics.

CRITICISM OF KEYNESIAN ECONOMICS: DEBATES AND CHALLENGES

While Keynesian economics has been widely influential, it has also faced significant criticism from various schools of thought.

Most famous critique of Keynesian economy was MILTON FRIEDMAN, American economist best known for his advocacy of free market.

Following are the main criticisms:

EXCESSIVE GOVERNMENT INTERVENTION

>Critics argue that Keynesian economics promote too much government control over the economy.

>Free-market economists, like those from the Austrian and Chicago School, believe that economies should be self-regulated rather than managed by government policies.

EXAMPLE: Some argue that government intervention during 2008 financial crises led to excessive public debt without long-term benefits.

RISK OF HIGH INFLATION & PUBLIC DEBT

Keynesian policies suggest increasing government spending during recessions, even if it means running a deficit.

>Critics warn that excessive government borrowing can lead to inflation, devaluation of currency, and long-term financial instability.

EXAMPLE: The U.S. and several other European countries faced rising public debt after implementing Keynesian stimulus packages during the COVID-19 pandemic.

SHORT-TERM FOCUS & “CROWDING OUT” EFFECT

>Keynesian economics focuses on short-term economic stability rather than long-term growth.

>Increased government borrowing may lead to higher interest rates, reducing private investment- this is known as crowding out effect.

EXAMPLE: In the 1970s, Keynesian policies led to stagflation (high inflation + high unemployment) in many Western economies, which Keynesian models struggled to explain.

IGNORES SUPPLY-SIDE FACTORS

>Keynesian economics emphasizes demand(spending) as the key driver of growth.

>Supply-side economists argue that government spending distorts market incentives. Instead of stimulating demand, they believe lower taxes and deregulation encourage businesses to produce more, leading to long-term growth.

EXAMPLE: The Reaganomics policies of the 1980s (reducing taxes & regulations) were based on supply-side theories, opposing Keynesian spending.

POLITICAL MISUSE OF KEYNESIAN POLICIES

>Governments often follow Keynesian policies during recessions (increasing spending) but fail to reduce spending during economic booms, leading to unsustainable deficits.

>Some critics argue that politicians misuse Keynesian policies for political gains rather than true economic stability.

EXAMPLE: Many governments continue high spending even in strong economic times, leading to long-term debt crises (e.g. Greece’s debt crises in 2010).

HENCE,

While Keynesian economics has shaped modern economic policies, critics argue that it can lead to inflation, public debt, and government overreach if not properly balanced.

Today, many economies use a mix of Keynesian and supply-side policies to achieve both short-term stability and long-term growth.

COUNTER ARGUMENTS

- Critique: “Government intervention leads to inefficiencies and crowding out.”

🔹 Counterargument: Keynesians acknowledge that the crowding out effects is mainly an issue when the economy is at full capacity. During recessions, private sector demand is low, government intervention boosts the demand and in fact, it encourages the private investors by creating a more favourable economic environment.

- Critique: “Deficit spending leads to unsustainable debt.”

🔹 Counterargument: Keynesian economic suggests that governments should run deficits during downturns and surpluses during boom. This counter- cyclical approach stabilizes the economy over time. Historically, countries like the U.S. and Japan have sustained large debt levels without economic collapse.

- Critique: “Keynesian policies cause inflation.”

🔹 Counterargument: Keynesian economics mentions that during recessions boosting demand would help reviving the economy and inflation mainly becomes a problem when demand outstrips supply.

- Critique: “People have rational expectations, so stimulus is ineffective.”

🔹 Counterargument: The idea of “rational expectations” assumes people perfectly anticipate economic policies, but in reality, economic decisions are often based on uncertainty, emotions, and imperfect information. Keynesians argue that stimulus works because people and firms do not always act with perfect foresight.

- Critique: “Keynesian economics ignores supply-side factors.”

🔹 Counterargument: Keynesianism does not ignore supply-side issues, but it emphasizes that supply-side policies alone (like tax cuts for businesses) are not enough during recessions when demand is weak. Keynesians support supply-side measures alongside demand-side policies for a balanced approach.

CONCLUSION

Keynesian economics remains a cornerstone of modern economic policy, demonstrating its effectiveness in mitigating recessions and stabilizing economies despite persistent criticism.

While concerns about inflation, public debt, and government overreach are valid, Keynesian principles have repeatedly proven their relevance, especially during economic crises such as the Great Depression, the 2008 financial crisis, and the COVID-19 pandemic.

The key strength of Keynesian economics lies in its pragmatic approach – recognizing that demand, not just supply, drives economic growth and that government intervention can be a necessary tool to restore stability. While some argue that excessive government spending can create inefficiencies, Keynesians counter that well-managed fiscal policies can prevent prolonged economic downturns.

Ultimately, no economic theory is without flaws, and a balanced approach—incorporating both Keynesian and supply-side principles—often yields the best results. As economies evolve, the debate over the role of government intervention continues, but Keynes’ insights remain highly influential in shaping economic policies worldwide.

MY POV

After critically examining the KEYNESIAN ECONOMICS and understanding the criticism as well as counterarguments we can say that despite strong criticism Keynesian economics was widely adopted due to its practical nature.

We have both the sides correct, criticism as well as counterarguments and I support both because Keynesian economics was developed after the Great Depression of 1920 when demand and employment were the lowest and this is what the major concern was.

Demand was the main focus to get out of the Great Depression.

The revolutionary idea of the Keynesian economics was that the government should intervene the economy through spending to stimulate demand in the face of recession even if it means going into debt, but as said earlier during recessions the demand is already low and unstable so the chances of it exceeding supply and causing inflation are practically lower.

While criticisms exist, Keynesian policies have proven effective in stabilizing economies during downturns, making them a crucial tool in modern economic management.

SOURCES

COUNCIL ON FOREIGN RELATIONS, CORPORATE FINANCE INSTITUTE, WIKIPEDIA, EUROPEAN CENTRAL BANK, MISES INSTITUTE, ECONLIB, FEDERAL RESERVE HISTORY, IMF, RBI, ECONOMICS ONLINE, BRITANNICA, STUDY.COM, INVESTOPEDIA, LUMEN LEARNING & CHATGPT.

📌 Author’s Note:

This blog is not just research — it’s a step in my journey toward working with global institutions like the IMF and World Bank.

Stay tuned and grow with me!

Amazing Work Autum 👏